Are you wasting hours trying to decide between FreshBooks vs QuickBooks, only to end up frustrated with inefficient bookkeeping? Many small business owners struggle with time management and productivity due to choosing the wrong accounting software. These common mistakes can seriously impact your workflow automation and overall efficiency. Luckily, by understanding the key differences and features of these popular small business tools, you can avoid costly errors and streamline your business finances for success.

This post dives deep into FreshBooks vs QuickBooks, exploring their features, time-saving benefits, and how to maximize productivity software to improve your bookkeeping workflow.

Key Features of FreshBooks and QuickBooks

Intelligent Workflow Automation

Both FreshBooks and QuickBooks offer robust bookkeeping software designed to automate routine tasks. FreshBooks is known for its intuitive invoicing and time tracking, while QuickBooks excels with comprehensive expense management and tax preparation tools. These features are vital for improving your workflow automation, reducing manual errors, and enhancing time management.

Small Business Tools Integration

QuickBooks integrates seamlessly with many other business finance solutions like payroll and inventory management, making it a versatile choice for growing businesses. FreshBooks, while more streamlined, offers excellent mobile apps and customer support, helping small business owners stay productive on the go.

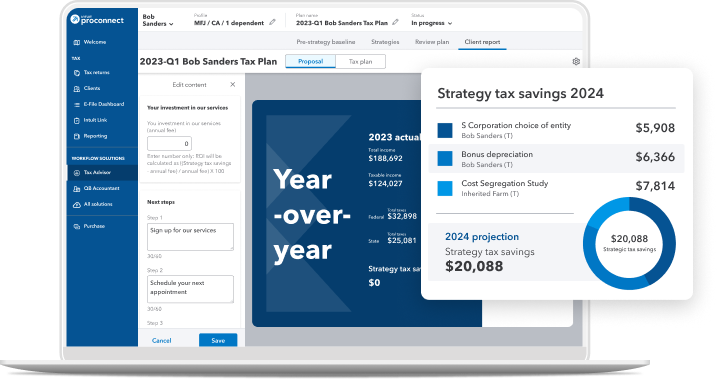

Custom Reporting and Analytics

Both platforms provide detailed reports that help you track financial health and make data-driven decisions. This is key for maximizing efficiency and managing your business finances more effectively.

Time Savings and Efficiency Gains for small business tools

Time management is critical when handling accounting tasks. Below is a comparison table highlighting how FreshBooks and QuickBooks save time compared to traditional manual bookkeeping:

| Task | Traditional Method | FreshBooks Time | QuickBooks Time | Time Saved (%) |

|---|---|---|---|---|

| Invoice Creation | 30 min | 5 min | 7 min | 75-83% |

| Expense Tracking | 45 min | 10 min | 12 min | 73-78% |

| Tax Preparation | 2 days | 5 hours | 4 hours | 60-80% |

| Reporting | 3 hours | 30 min | 45 min | 75-83% |

By automating these workflows, both FreshBooks and QuickBooks dramatically improve your business’s productivity and reduce time spent on bookkeeping by up to 80%.

Step-by-Step Guide to Using FreshBooks and QuickBooks

Step 1: Set Up Your Account

Create your profile and connect your bank accounts. Both FreshBooks and QuickBooks guide you through linking your business accounts for seamless transaction import, speeding up your bookkeeping setup.

Step 2: Automate Invoicing

Use the invoicing templates to automate billing. FreshBooks’s user-friendly interface makes it easy to send and schedule invoices, while QuickBooks allows automatic reminders, improving cash flow and saving time.

Step 3: Track Expenses Effortlessly

Snap photos of receipts with FreshBooks mobile app or import bank statements in QuickBooks. This automates expense tracking and reduces manual data entry errors.

Step 4: Generate Reports

Leverage custom reports to monitor profits, losses, and tax obligations. Regularly reviewing reports helps improve financial decisions and keeps your business efficient.

Benefits and Value Proposition

Improved Time Management: Automated workflows save hours weekly, freeing you to focus on growth.

Enhanced Productivity: Streamlined bookkeeping processes reduce errors and speed up financial tasks.

Workflow Automation: Features like recurring invoices and auto-expense categorization simplify daily operations.

Integrated Small Business Tools: Both platforms offer integrations that support payroll, taxes, and inventory management.

Better Financial Visibility: Real-time reporting improves decision-making and tax compliance.

Users report up to a 40% increase in productivity after switching from manual bookkeeping to FreshBooks or QuickBooks.

Alternative Solutions and Complementary Tools

While FreshBooks and QuickBooks are top choices, alternatives like Xero and Wave also offer solid bookkeeping software with distinct advantages. However, QuickBooks’ extensive integrations and FreshBooks’ mobile-first design often make them more efficient for specific business needs.

For businesses needing advanced workflow automation, combining these tools with project management software like Trello or Asana can enhance productivity further.

Use Cases and Implementation Ideas

Freelancers and Consultants: FreshBooks’ time tracking and invoicing features streamline billing.

Small Retailers: QuickBooks’ inventory and payroll integrations support retail operations efficiently.

Startups: Both tools support scalable bookkeeping solutions to grow alongside your business.

Remote Teams: Cloud-based platforms ensure seamless collaboration and financial management.

By tailoring features to your business type, you optimize workflow automation and enhance time management.

Common Mistakes to Avoid

Choosing software without assessing your specific business needs.

Ignoring workflow automation features that save time and reduce errors.

Failing to regularly update financial data, leading to inefficient bookkeeping.

Underutilizing reporting tools that provide critical business insights.

Using FreshBooks or QuickBooks correctly helps you avoid these pitfalls and maintain efficient bookkeeping.

Tips for Maximizing Results

Regularly reconcile your accounts to ensure accuracy.

Customize invoice templates to match your brand and improve client experience.

Use mobile apps to update expenses and invoices on the go.

Set up automatic reminders to reduce late payments.

Schedule regular report reviews to stay on top of your finances.

Consistent use of these features will lead to significant improvements in productivity and time management.

Conclusion

Choosing between FreshBooks vs QuickBooks can be challenging, but avoiding costly mistakes will save you time and boost efficiency. These powerful small business tools enhance workflow automation, improve productivity, and simplify your bookkeeping. Ready to boost your team’s efficiency? Try FreshBooks or QuickBooks today and experience smarter business finance solutions.

FAQs

Q: Which software is better for freelancers?

A: FreshBooks is ideal for freelancers due to its user-friendly invoicing and time tracking features.

Q: Can QuickBooks handle payroll?

A: Yes, QuickBooks integrates payroll services, making it suitable for small to medium businesses.

Q: How do these tools improve time management?

A: Both automate manual tasks like invoicing and expense tracking, freeing up hours weekly.

Q: Are these platforms suitable for remote teams?

A: Absolutely. Their cloud-based access enables real-time collaboration from anywhere.